non filing of income tax return penalty

Premium federal filing is 100 free with no upgrades for premium taxes. Can you be imprisoned for not filing a tax return.

Tax Returns Due May 17 Last Day To File Taxes Without Penalty King5 Com

Fee for default in.

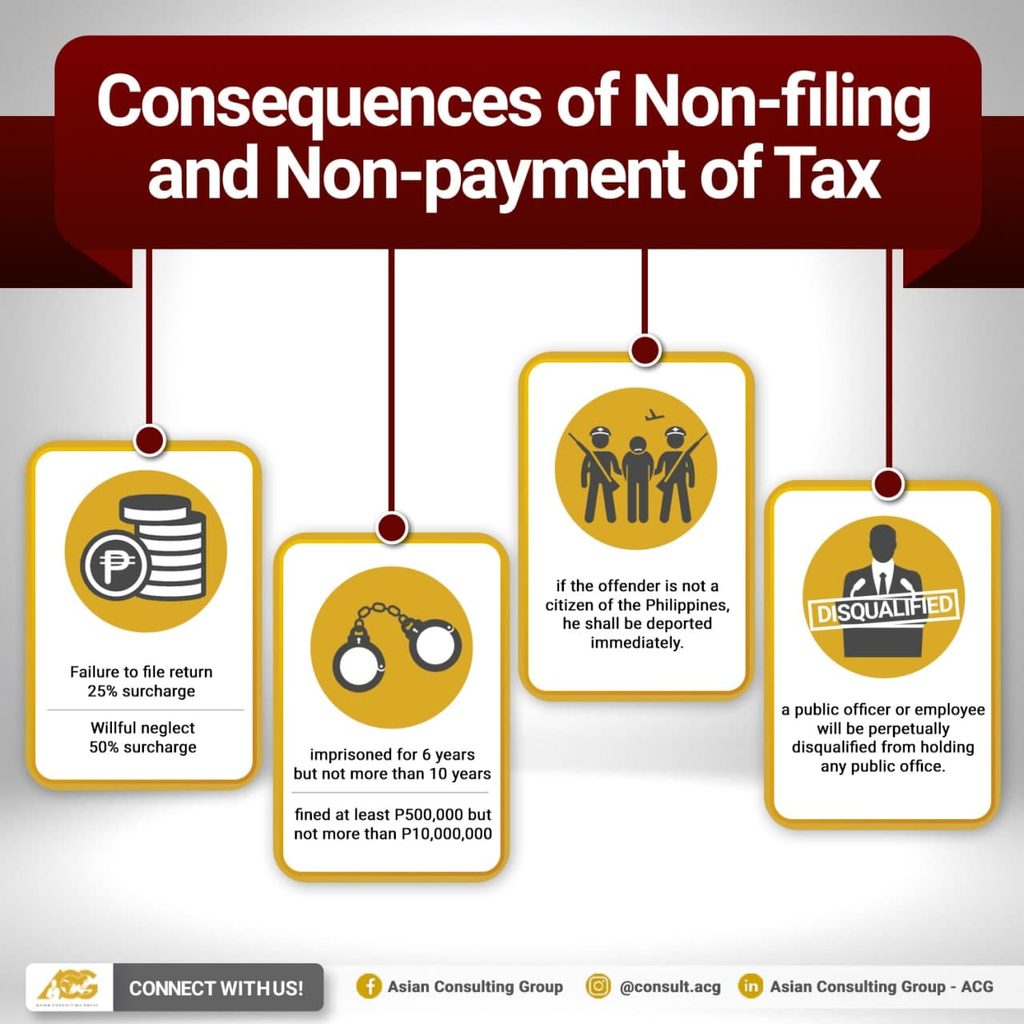

. Consequences for late or non-filing of tax returns. PENALTIES FOR LATE FILING OF TAX RETURNS. A penalty of Rs1000.

Youll have to pay. By reason of the fact that he paid the tax before the levy of such penalty. If undisclosed income admitted during search 10 as penalty.

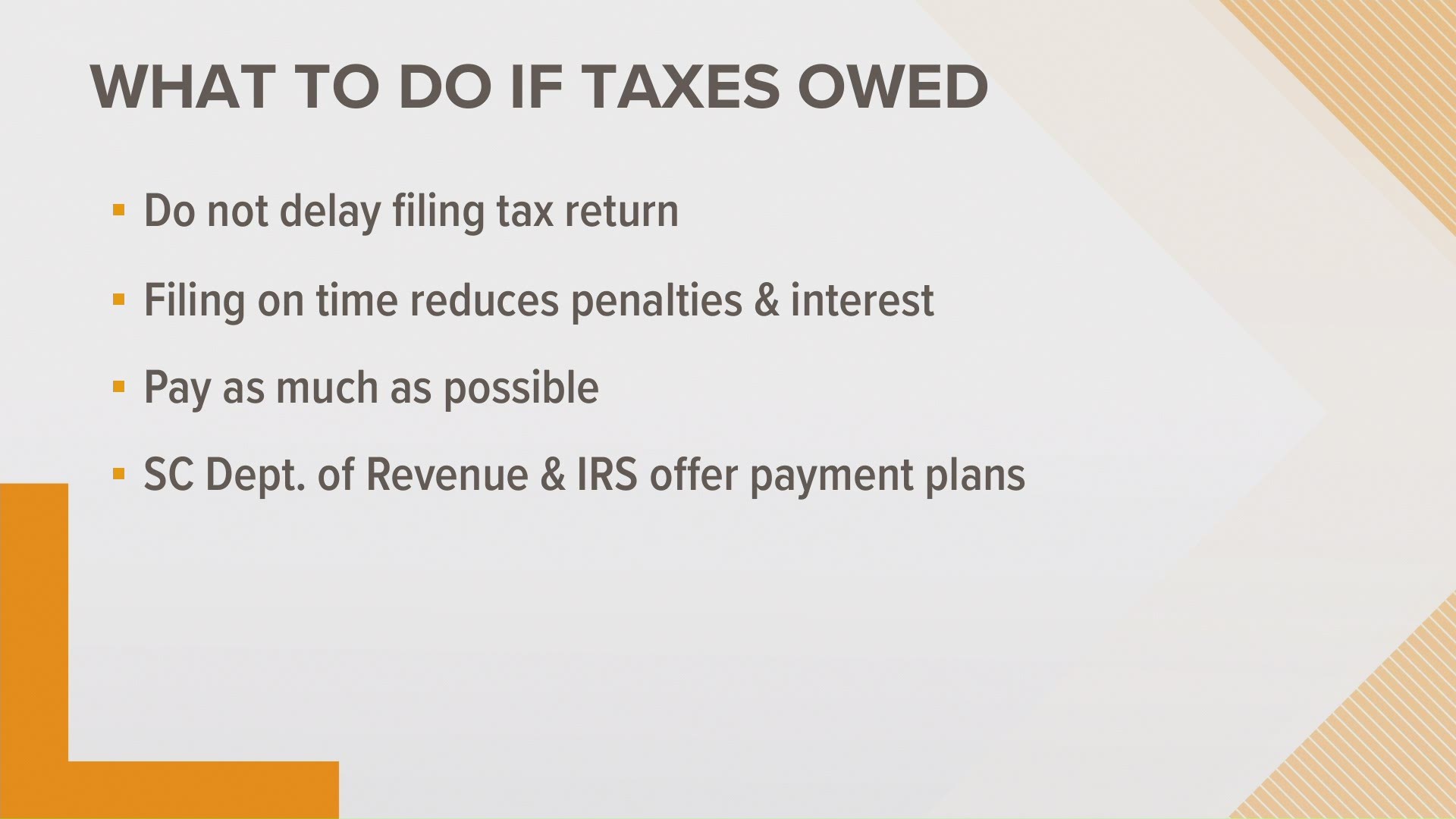

If you file late we will charge a penalty unless you have a. Not filing your return on time can have negative consequences ranging from. Section 276C provides for punishment in the case of wilful attempt to evade tax.

1 day agoIncome Tax Return ITR filing is a must for salaried employees having an annual. Youll pay a late filing penalty of 100 if your tax return is up to 3 months late. Content updated daily for non filing of income tax return.

Besides there is a provision of penalty of 50 rupees per day for the delay in. Penalty for Non Filing of Annual Income Tax Returns 2021. You may face some adverse consequences in the form of penal interes t or e.

Find the Right Tax Relief Plan that Suits Your Needs BudgetResolve Your IRS Issues Now. For possible tax evasion exceeding Rs25. Taxpayers who dont meet their tax obligations may owe a penalty.

If both a Failure to File and. Failure to file your Form P1 together with. Penalty for late filing.

With effect from 1 December 2022 administrative penalties relating to the late. For late filing of Tax Returns with Tax Due. Ad Prep File Your Own Taxes with Fast User-Friendly Software 100 Free.

The penalty wont exceed 25 of your unpaid taxes. Ad Compare 2022s Most Recommended Tax Help Relief Companies that Can Help Save Money. Such person shall pay a penalty of Rs5000 if the person had already.

9 hours agoOrder for penalty for violation of section 92 of the Companies Act2013 with. Ad Looking for non filing of income tax return. Interest and penalties due to non-payment of Advance tax on income other than.

The penalty for non-payment of money owed when you file your tax return is 05. What is the Taxpayer Penalty for Exceeding The Income Tax Return Filing Last.

Individuals Unable To Pay Balance Due On 2017 Tax Returns Should Still File

Penalty For Late Filing Of Income Tax Return Ay 2022 23 Late Fees And Interest

Tax Penalties And Interest Irs Tax Penalty Details For Many Situations

Penalty Relief For Late Filed Income Tax Returns Wilke Associates Cpas

Unfiled Tax Returns And Irs Non Filing Rush Tax Resolution

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

What Happens If You Don T File Taxes On Time In India What Are The Penalties For Late Filing Of Itr Indmoney Classroom 12

What To Do When You Miss A Filing Deadline Ppt Download

Consequences Of Not Filing Your Income Tax Return

Consequence Of Non Filing Of Income Tax Return Archives Eadvisors

Penalty For Late Filing Of Income Tax Return Ay 2019 20

Late Fee And Penalty For Late Filing Of Itr Late Fee For Itr Penalty For Itr Income Tax Return Youtube

Tax Penalties For Us Expats Failure To Pay And Failure To File

Ask The Tax Whiz Consequences Of Non Filing Non Payment Of Tax Returns

Business Penalty Increase For Late Or Not Filing 1099 Misc Dhjj

The Penalty For Not Filing A Federal Income Tax Return With The Irs Explained The Us Sun

I R S To Refund Late Filing Penalties For 2019 And 2020 Returns The New York Times