iowa capital gains tax rates

Iowa Department of Revenue 2016. Capital Gains Tax 2021 In Iowa with Ingredients and.

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Includes short and long-term Federal and.

. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. State Tax Rate ex. The rate reaches 715 at maximum.

Iowa is a somewhat different story. The Combined Rate accounts for Federal State. Additional State Capital Gains Tax Information for Iowa.

Iowa Capital Gains Tax. Your average tax rate is 1198 and your marginal tax rate is 22. The average surtax is 03 weighted by income according to Tax Foundation data and total of 297 Iowa school districts impose an income tax surcharge.

Introduction to Capital Gain Flowcharts. Capital gains tax rates can be confusing. The daily rate for 2022 is the annual rate divided by 365.

The monthly rate is the annual rate divided by 12 rounded to the nearest one-tenth of a percentage point. Tax rate Income 033 0 to 1743 067. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177.

Toll Free 8773731031 Fax 8777797427. What is the Iowa capital gains tax rate 2020 2021. Iowa capital gains tax rates.

Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898. Iowa Income Tax Calculator 2021. The special rates are maximum rates.

Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa.

Iowa has a cigarette tax of 136 per pack. Both long- and short-term capital gains are taxed at the full Iowa income tax rates depending on your income. The top rate will lower to 6 giving a tax cut to Iowans making 75000 or more.

The table below summarizes uppermost capital gains tax rates for Iowa and neighboring states in 2015. CRP enrollment is the highest in Texas Colorado Kansas and Iowa. Iowa allows taxpayers to deduct federal income taxes from their state taxable income.

On March 1 2022 Governor Kim Reynolds signed HF 2317 into law. The Iowa capital gain deduction is subject to review by the Iowa Department of. Taxes capital gains as income and the rate reaches 853.

The top rate will lower to 57 giving a tax cut to. The new tax law will reduce individual and corporate income tax rates provide exemptions from Iowa tax for. If your ordinary tax rate is lower than the special rate ie either 10 12 22 or 24 your ordinary tax rate may apply to gain on.

How are capital gains taxed in Iowa. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. For example if your local school. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161.

Iowa is a somewhat different story. When a landowner dies the basis is automatically reset to the current fair. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Capital GAINS Tax. Total rental payments are 18 billion and the average rental rate increased this year to 82 per acre. Heres how the rates will change.

No one says you have to.

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group

Wisconsin Capital Gains Tax Everything You Need To Know

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Combined Capital Gains Tax Rate In Missouri To Hit 48 8 Under Biden Plan Missouri Thecentersquare Com

How Do State And Local Individual Income Taxes Work Tax Policy Center

Cryptocurrency Taxes What To Know For 2021 Money

Elimination Of Stepped Up Basis Poses Hazards To Family Farms

Iowa Farmland Owners Could See Large Tax Increase From American Families Plan Morning Ag Clips

House Democrats Propose Raising Corporate Capital Gains Tax Rates Pensions Investments

Capital Gains Tax Calculator 1031 Crowdfunding

Obama Should Leave The Capital Gains Tax Rate At 15 Seeking Alpha

What You Need To Know About Capital Gains Tax

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

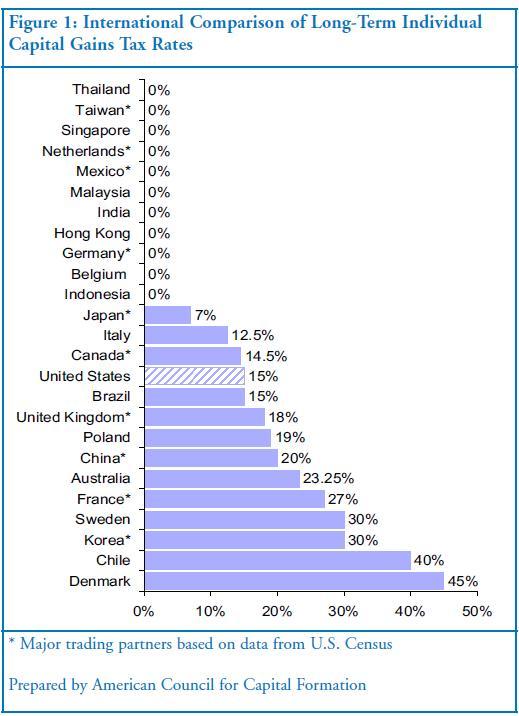

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos